Market Research identifies the current dynamics in a specific market for a specific item such as the market size, customer perception, ideal price, nature of the market, and a lot more things. To do these, researchers like me need to collect data from various sources, and according to these sources, a market research operation can be divided into 4 segments.

This article identifies these four kinds of research based on how much interaction is needed with the end user. The first one is based on zero direct interaction while the final one is based on one-on-one interviews.

1. Customer Observation

Customer Observation is the cheapest and the quickest way of doing market research. Here, known and potential customers are observed for their browsing, product evaluation, and purchasing behavior, to obtain insights on their habits.

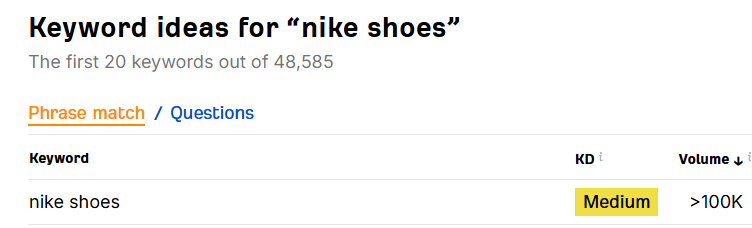

One example of customer observation is via “Keyword Research”, which is a collection of data showing how many people have searched for a specific thing on search engines (Google, Bing, Yahoo, etc.). More searches means more demand in the market for that product. Based on the data, the researcher understands the need for a certain product in the market.

Here, the researcher reaches the highest number of people among all other market research methods.

Though this is the easiest type of research and also the least expensive one, it has a few drawbacks. Customer observation always shows incomplete data because of some limitations.

For example, in the above data point, we know that there are at least 100,000 people searching for Nike shoes every month, however, there is no insight on the people searching these on other websites like Amazon or Walmart. Further, there is no data on people buying it offline.

2. Surveys

Surveys are an opinion collection exercise where the surveyor asks the questions to a specific set of consumers. These consumers could voluntarily provide data, or receive some kind of reward to participate in the survey.

They reach a lesser amount of people than customer observation but gain deeper insights into the minds of the end consumer.

For the sake of a true opinion, surveys are recommended to be taken without any reward so that the person being surveyed doesn’t feel obliged to give favorable answers.

The common platforms for conducting surveys are:

- Online

- Survey Monkey

- Offline

- Shopping Malls

- Market Grounds (like Sarojini in Delhi)

- Partnered surveys, where you partner with a large organization and take a survey of their employees

- Anonymous surveys via dropboxes

A drawback of these surveys is that if they are longer than 3-5 minutes, the surveyor loses interest and then there is a high chance of them giving wrong opinions. Further, there is no guarantee on the genuinty of opinions in a survey.

3. Focus Groups

Focus groups are a set of people united by a common theme such as a TV show, cricket fans, by their profession, their age, their income, etc. These people often tend to form groups/clubs and discuss their common interest in great depth. This research is done for niche markets where the needs of the researcher is properly delineated and the size of the group is not too large (such as in millions).

A researcher can easily get unbiased opinions from these groups about their common interests.

Some online and offline examples of such focus groups are:

- Online

- Reddit groups (called Subreddits)

- Discussion Forums

- Offline

- Boatowners club

- Veterans club

- Trade Unions

- Comicon members

However, getting into these groups requires specialized experience or the researcher might get alienated from them.

4. Interviews

Interviews are the most detailed research but have a very limited reach. Each interview is usually conducted on camera with at least 30 minutes time to address the needs of the questionnaire. The interviewed person is presented with choices, alternatives, and is walked through several products (both original and fake) to know their perception.

This kind of research is most difficult to conduct because, for the sake of removing indebtedness from the subject’s mind, the interview has to be without any reward.

Interviews have the most in-depth data on any matter and are usually conducted at a sub-niche level.

An example of an interview: A study was done by a cake agency where two identical cakes were labeled $15 and $50 and users were asked to tell which one was tastier. Almost all of them chose the $50 one despite both being the same. This interview shows how price can be a strong determinant of quality perception.